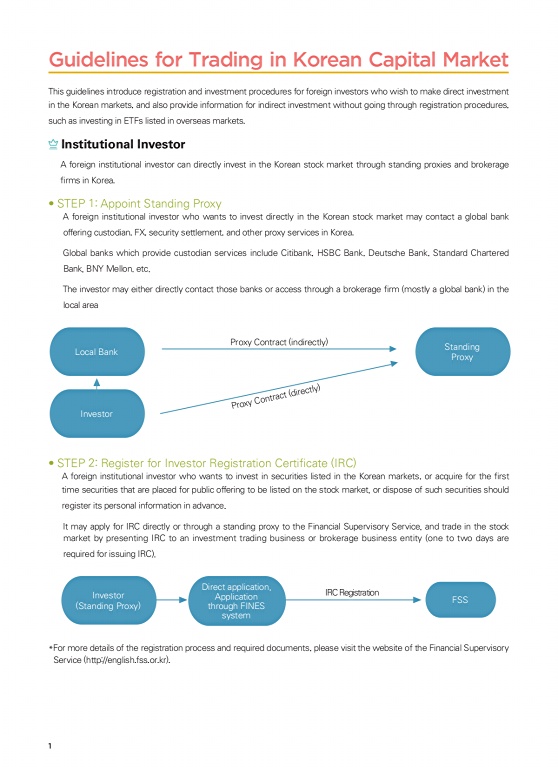

1페이지 내용 : Guidelines for Trading in Korean Capital Market This guidelines introduce registration and investment procedures for foreign investors who wish to make direct investment , , in the Korean markets and also provide information for indirect investment without going through registration procedures such as investing in ETFs listed in overseas markets. Institutional Investor A foreign institutional investor can directly invest in the Korean stock market through standing proxies and brokerage rms in Korea. • STEP 1: Appoint Standing Proxy A foreign institutional investor who wants to invest directly in the Korean stock market may contact a global bank , , , . offering custodian FX security settlement and other proxy services in Korea , , , Global banks which provide custodian services include Citibank HSBC Bank Deutsche Bank Standard Chartered , . . Bank BNY Mellon etc ( ) The investor may either directly contact those banks or access through a brokerage rm mostly a global bank in the local area ( ) Proxy Contract indirectly Standing Local Bank Proxy ) ly t ( irec d t trac Con xy ro P Investor 2: ( ) • STEP Register for Investor Registration Certicate IRC , A foreign institutional investor who wants to invest in securities listed in the Korean markets or acquire for the rst , time securities that are placed for public offering to be listed on the stock market or dispose of such securities should register its personal information in advance. , It may apply for IRC directly or through a standing proxy to the Financial Supervisory Service and trade in the stock market by presenting IRC to an investment trading business or brokerage business entity (one to two days are required for issuing IRC). Direct application, Investor Application IRC Registration FSS (Standing Proxy) through FINES system , *For more details of the registration process and required documents please visit the website of the Financial Supervisory ( : . . . ). Service http//english fss or kr 1

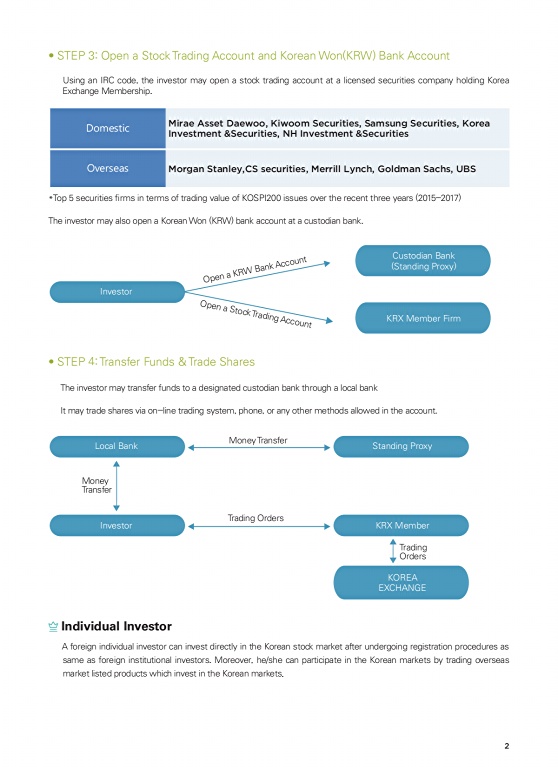

2페이지 내용 : 3: ( ) • STEP Open a Stock Trading Account and Korean Won KRW Bank Account , Using an IRC code the investor may open a stock trading account at a licensed securities company holding Korea Exchange Membership. Domestic Mirae Asset Daewoo, Kiwoom Securities, Samsung Securities, Korea Investment &Securities, NH Investment &Securities Overseas Morgan Stanley,CS securities, Merrill Lynch, Goldman Sachs, UBS *Top 5 securities firms in terms of trading value of KOSPI200 issues over the recent three years (2015-2017) ( ) . The investor may also open a Korean Won KRW bank account at a custodian bank Custodian Bank t ccoun A ( ) k Standing Proxy an B W R K a en Op Investor O pen a S t oc k T rad i n g A KRX Member Firm ccount • STEP 4: Transfer Funds & Trade Shares The investor may transfer funds to a designated custodian bank through a local bank - , , . It may trade shares via on line trading system phone or any other methods allowed in the account Money Transfer Local Bank Standing Proxy Money Transfer Trading Orders Investor KRX Member Trading Orders KOREA EXCHANGE Individual Investor A foreign individual investor can invest directly in the Korean stock market after undergoing registration procedures as . , same as foreign institutional investors Moreover he/she can participate in the Korean markets by trading overseas market listed products which invest in the Korean markets. 2